CHILDCARE & ACADEMIC ASSISTANCE PROGRAM

Applications Are Now Closed

Applications for ResourceWest’s Childcare & Academic Assistance Program are currently closed for the 2025 summer and school year.

The next application period will open on February 2, 2026, for support during the 2026 summer and school year.

Thank you for your interest in our programs. Please check back closer to the opening date for updated application information.

What is the Childcare and Academic Assistance Program?

The Childcare & Academic Assistance Program supports income-eligible residents in Hopkins, Minnetonka, Excelsior, Shorewood, Deephaven, Woodland, and Greenwood.

The program offers financial assistance that covers 50% of tuition for partner childcare and tutoring services.

Its goal is to help children access stable childcare and academic enrichment while enabling caregivers to maintain or seek employment. We aim to enhance access to high-quality childcare and educational assistance for families facing various barriers.

ResourceWest provides financial assistance for the following childcare organizations:

Who is eligible to receive a Childcare and Academic Assistance Scholarship?

Families must meet specific income requirements and have an eligible child to qualify for the scholarship. The general eligibility criteria are:

- The child must reside in ResourceWest’s service area, which includes Hopkins, Minnetonka, Excelsior, Shorewood, Woodland, or Greenwood.

- The family’s household income must be equal to or less than 47% of the State Median Income, or the family must receive assistance from an approved state or federally funded program.

- Children in preschool through fifth grade are eligible.

How much financial assistance is available?

Award amounts depend on the program type, location, and the child’s age. Scholarships cover 50% of the tuition for one program period per application (summer or school year).

How do families receive scholarship funds?

Scholarship funds are paid directly to the program the child will attend.

How do families apply?

Families can apply for a Childcare and Academic Assistance Scholarship by using the application available on the ResourceWest website.

The application can be downloaded and submitted to a ResourceWest Case Manager. Alternatively, a paper application can be requested from a ResourceWest Case Manager.

Completed applications and any required supporting documents can be mailed to ResourceWest or delivered in person to their office.

Office address: 13231 Minnetonka Drive, Minnetonka, MN 55305.

How will families know the outcome of their application?

Families will be notified via email regarding the outcome of their application.

What must families do to maintain a scholarship?

- A child who receives a Childcare and Academic Assistance Scholarship must enroll in an eligible program within 7 days of being awarded the scholarship, or within 7 days from the opening of the program’s registration (whichever is later). If enrollment does not occur within this timeframe, the scholarship will be canceled unless an official exemption is granted. If the scholarship is canceled, the family must reapply to be eligible for another one.

- Families must pay the tuition not covered by the scholarship on time, and their child must regularly attend scheduled childcare or tutoring sessions. If a child misses more than two weeks of sessions without notice or if the family's portion of the tuition remains unpaid for more than two weeks, the scholarship may be canceled. If the scholarship is canceled, the family must reapply to be eligible for another one.

- Once awarded, a child can continue to receive the scholarship if funds are available until they are no longer age-eligible or have received a scholarship for a maximum of two years.

- Families must renew their child’s scholarship each year between February 1st and September 1st. Each child may receive a scholarship for a maximum of two calendar years.

Income Eligibility Requirements

To qualify for a Childcare and Academic Assistance scholarship, your household income must be at or below 47% of the State Median Income, or you must be receiving assistance from specific programs like:

- Free or reduced-price meals

- MHCP (health care assistance)

- WIC

- SNAP

- MFIP (cash assistance)

- and other assistance programs

You'll need to provide proof of your financial situation, such as documentation showing your child's participation in a public program or proof of your income.

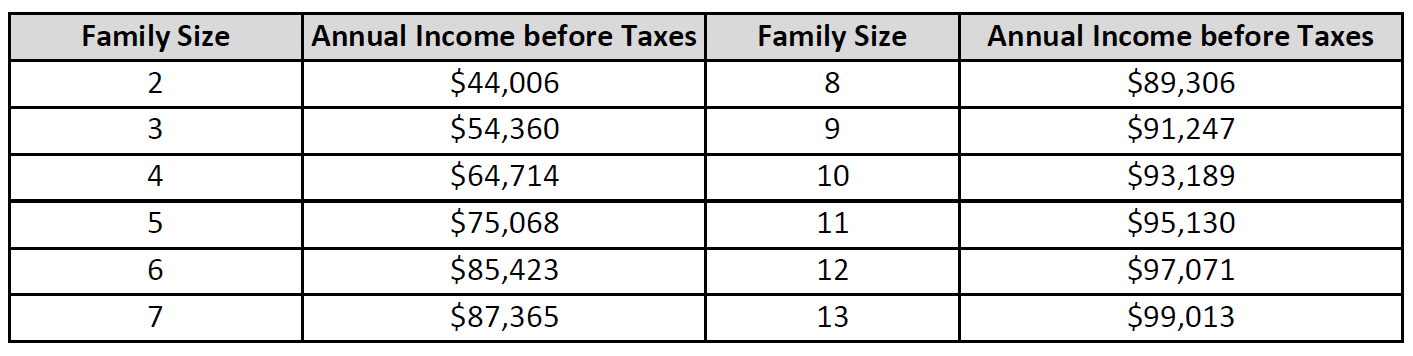

See our income guidelines below.

Proof of Participation in a Public Program

If your family takes part in a public program, you need to provide documents that show your participation with your application. If you are involved in more than one program, include proof for at least one of them.

Acceptable forms of proof include:

- Official notice on program letterhead

- An application with program approval or signature

- An acceptance letter from the public program

- A letter or status statement from your county

- A screenshot from an official system of record from the program

The proof must include the name of the parent or guardian and/or child(ren), be dated, and be valid when you apply.

Unacceptable proof includes:

- Waitlist letters

- Unapproved applications

- Documents without a date

- Expired documents

Proof of Income

If your family does not take part in a public program, you must show that your household income is equal to or less than 47 percent of the State Median Income. Include proof of all income earned by each adult in your household with your application. (See the image above)

For this program, your household includes anyone living with you who shares income and expenses. Report income for all adults (age 18 and older) in your household.

Sources of Income for Adults

Gross Pay from Work: Salary, wages, cash bonuses (before taxes or deductions).

If you are in the U.S. Military:

- Basic pay and cash bonuses (do not include combat pay, FSSA, or privatized housing allowances).

- Allowances for housing, food, and clothing off-base.

Self-Employed or a Farmer: Net income from self-employment (business or farm).

Child Support, Alimony: Payments received for child support or alimony.

All Other Incomes:

- Cash assistance from state or local government

- Unemployment benefits

- Worker’s compensation

- Veteran’s benefits

- Strike benefits

- Social Security or Disability Benefits

- Regular income from trusts or estates

- Annuities, investment income, rental income

- Regular cash payments from outside the household

Acceptable proof includes the previous year’s W-2 form, the most recent consecutive 30 days of pay stubs for each income earner, a financial aid statement, or a statement from an employer on company letterhead.

Please submit the most current documentation you have. Pay stubs must be dated within one month of the application.

If you can’t provide other forms of documentation, you can use last year’s income tax filing documents. These must be a copy of the signed version submitted to the IRS or include the confirmation if filed electronically.

Connect with Staff

Kirsten Anderson (Spanish/English):

- 952-322-0882

- kirsten@resourcewest.org

Anab Omar (Somali/English):

- 952-322-0357

- anab@resourcewest.org